Irs Schedule 8812 For 2024 Calendar – By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments . The IRS Tax Refund Calendar 2024. This means that for those filing from January 23 to 28, potential refund dates include February 17 for direct deposit and February 24 for mailed checks. The .

Irs Schedule 8812 For 2024 Calendar

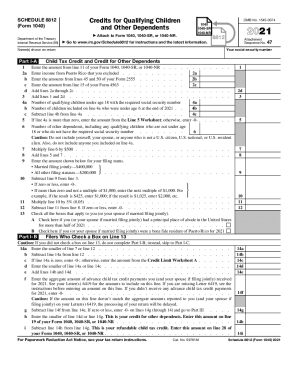

Source : fox59.com2023 Form IRS 1040 Schedule 8812 Fill Online, Printable

Source : 1040a-child-tax-credit.pdffiller.comMost Americans feel they pay too much in taxes, AP NORC poll finds

Source : fox5sandiego.comIRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com2011 2024 Form IRS 8812 Fill Online, Printable, Fillable, Blank

Source : irs-8812-fillable.pdffiller.comFree tax filing tool coming to New York State

Source : www.rochesterfirst.comYou can start filing your taxes on the 29th of January | WGN Radio

Source : wgnradio.comIRS moves forward with free e filing system in pilot program to

Source : www.wowktv.comIRS Schedule 8812 (1040 form) | pdfFiller

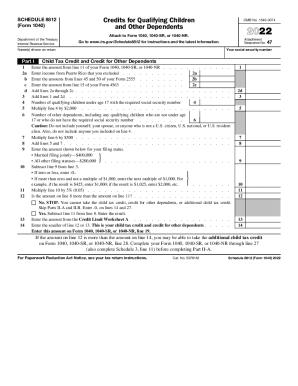

Source : www.pdffiller.comSchedule 8812 2022 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comIrs Schedule 8812 For 2024 Calendar Understanding IRS Form 8812 for Child Tax Credit in 2023 and 2024: a publication for tax pros, which publishes a refund calendar based on average timetables for IRS refunds over the last 20 years. “The most important factor in receiving a refund as quickly as you . or by October 2024 with a tax extension. A claimant must also fill out Schedule 8812, which is to be submitted alongside the 1040 document. The refund should be paid by February 2024 as the .

]]>